The Bitcoin (BTC) price has experienced significant volatility recently, amid growing concerns over waning risk appetite among investors and the recent government sell-offs. For context, the German and U.S. governments have offloaded substantial amounts of BTC to crypto exchanges, contributing to the market’s current uncertainty. However, despite this bearish trend, market analysts remain optimistic about

The post Popular Analyst Predicts BTC Price Reversal After A Dip To This Level appeared first on CoinGape.

The Bitcoin (BTC) price has experienced significant volatility recently, amid growing concerns over waning risk appetite among investors and the recent government sell-offs. For context, the German and U.S. governments have offloaded substantial amounts of BTC to crypto exchanges, contributing to the market’s current uncertainty.

However, despite this bearish trend, market analysts remain optimistic about a potential price reversal.

Analyst Predicts Reversal After BTC Dips To Key Level

Renowned crypto market analyst Michael van de Poppe has shared a bullish outlook for BTC, despite its recent price struggles. In a recent X post, the analyst suggested that Bitcoin could experience a further decline before staging a significant recovery.

He emphasized that a reversal could occur after Bitcoin reaches the $60,000 level, a price point he believes will trigger a bullish divergence. For the reversal, he has focused on the potential approval of the U.S. Spot Ethereum ETF by the SEC next week.

Meanwhile, Van de Poppe’s forecast aligns with growing speculation about the most awaited U.S. SEC’s potential approval of Spot Ethereum ETF on July 2. If granted, the approval is expected to enhance market sentiment, possibly driving Bitcoin’s price higher alongside Ethereum’s potential gains.

Analysts believe that the introduction of an Ethereum ETF could bolster institutional interest and overall investor confidence in the cryptocurrency market, thereby benefiting BTC price as well.

Also Read: Japanese Yen Collapse May See More Firms Adopt Bitcoin (BTC) Very Soon

Analyst Believes Miner Selling Concerns Overstated

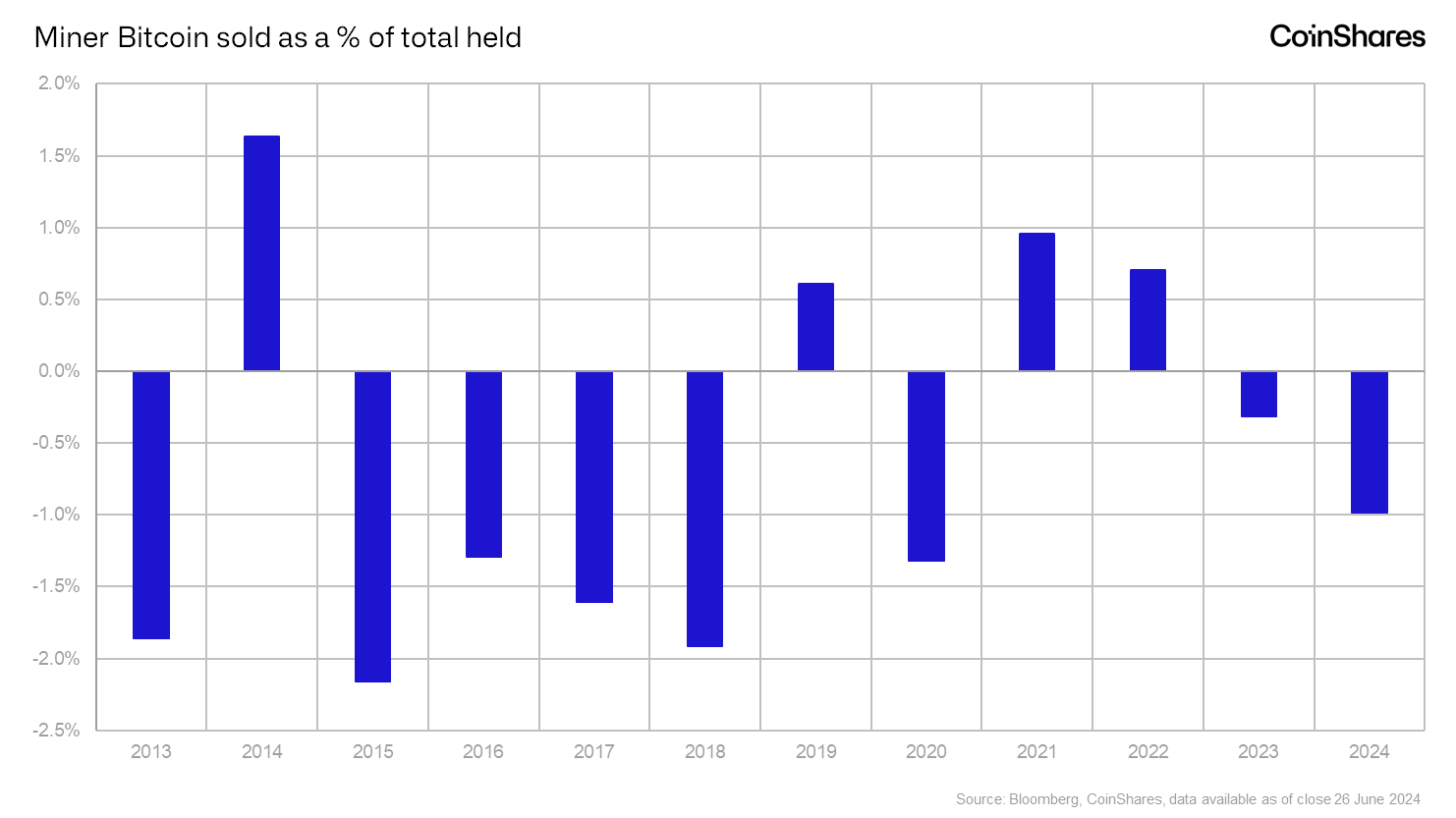

Some market participants have expressed concerns about Bitcoin miners selling off their holdings, leading to additional market pressure. However, James Butterfill, Head of Research at CoinShares, argues that these fears may be overblown.

In a recent X post, Butterfill clarified that miners have sold a record amount of Bitcoin this year— “over $1 billion worth”. However, Butterfill pointed out that when considering the proportion of total Bitcoin held, miners’ sales are not as significant as they appear. James Butterfill said:

“When looking at things proportionally you find that miners selling as a proportion of total Bitcoin held isn’t all that significant at 1% this year so far compared to 2% in 2018 and 2015.”

Butterfill’s analysis suggests that while miners are selling more Bitcoin, the overall impact on the market is relatively minor compared to historical precedents. This insight provides a more nuanced perspective on the current market dynamics and suggests that the concerns over miner sell-offs might not be as detrimental to Bitcoin’s price as initially feared.

Meanwhile, during writing, Bitcoin price traded at $61,565.45, up about 0.05%, with its trading volume slipping 12.6% to $22.48 billion. Over the last 24 hours, the flagship crypto has touched a low of $60,580.78, with BTC Futures Open Interest rising 0.82% in the four-hour time frame.

Also Read: Pro-XRP Lawyer Deaton Highlights US Govt and SEC’s Contradictory Stance On Coinbase

The post Popular Analyst Predicts BTC Price Reversal After A Dip To This Level appeared first on CoinGape.